Regional Site Tracker: Latin America and the Caribbean

(part 1 in our 3-part series on Latin America and the Caribbean)

Latin America and the Caribbean have an important role to play in the evolving outsourcing industry. The Latin America and Caribbean Outsourcing Council (LACOC) is IAOP’s newest assembly of thought leaders helping to guide the Association in its efforts to deliver value to the members in Latin America and the Caribbean.

LACOC members include: Mauricio Velasquez, COP, COP-B, Managing Director, Valesquez & Company; Atul Vashistha, COP, Chairman, Neo Group, IAOP Hall of Fame; Michael Mensik, COP, Partner, Baker & McKenzie; Santiago Pinzon, Vice President, Digital Transformation, ANDI; Anupam Govil, Partner, Avasant; and Ana Karina Quessep, Director, Asociacion Colombiana de Contact Centers.

LACOC members include: Mauricio Velasquez, COP, COP-B, Managing Director, Valesquez & Company; Atul Vashistha, COP, Chairman, Neo Group, IAOP Hall of Fame; Michael Mensik, COP, Partner, Baker & McKenzie; Santiago Pinzon, Vice President, Digital Transformation, ANDI; Anupam Govil, Partner, Avasant; and Ana Karina Quessep, Director, Asociacion Colombiana de Contact Centers.

In this issue, Velasquez and Vashistha share their expert insights into what’s important to pay attention to in this part of the world.

[emaillocker id=26087]Size of the Market

With a population of approximately 650 million people, representing 8.42 percent of the world’s total population, Latin America and the Caribbean is geographically broad with an interesting mix of cultures, countries and challenges. According to Velasquez, most LAC countries, independent of size, have good growth opportunities driven by customers desire for language speaking and soft people skills. Government support also will help proper further growth but limitations in its digital workforce could create challenges.

State of Latin America and the Caribbean as an Outsourcing Destination

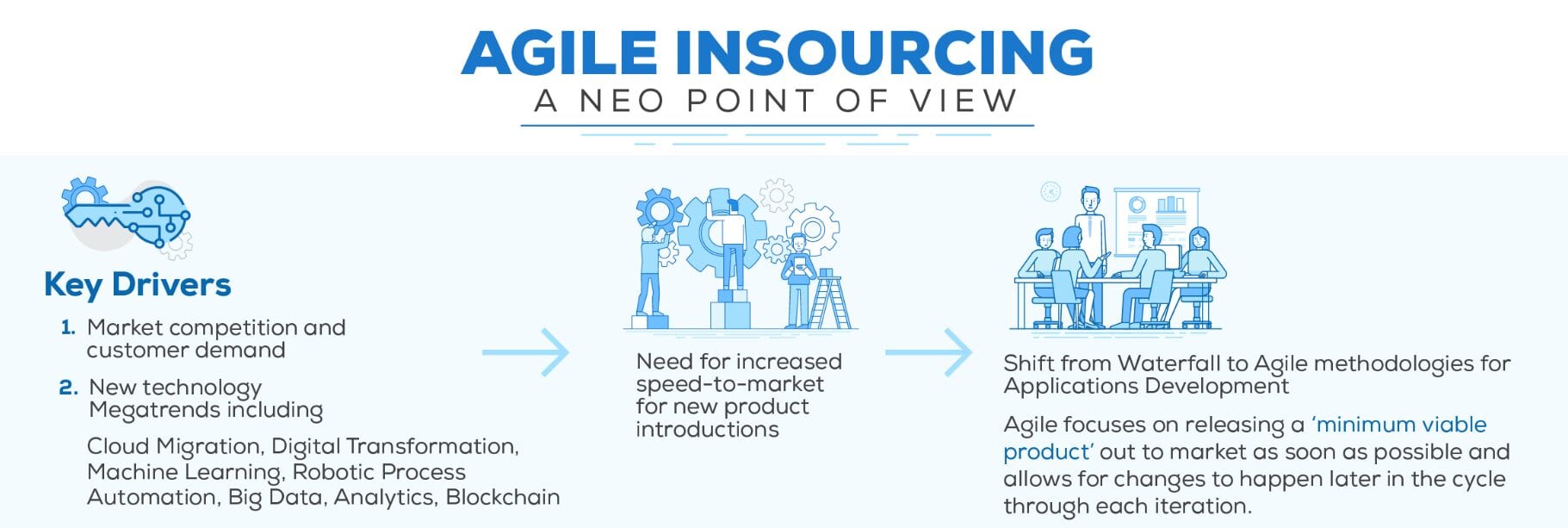

Vashistha notes that outsourcing has evolved. When outsourcing began, the key drivers were a shortage of talent and increasing pressure to reduce costs. Addressing these pressures by outsourcing using traditional application development methodologies like Waterfall, which were easily adaptable to shifting work between in-house and outsourced teams, worked very well. Working in vastly different time zones wasn’t an issue and may have even facilitated this way of working.

However, with today’s advancements in technology, many executives are recognizing the limitations of the traditional application development methodologies and are switching their teams to Agile. As the Agile philosophy supports a collaborative environment where cross-functional teams work together, working in vastly different time zones can present a significant hurdle.

Additionally, new technologies like Cloud Migration, Digital Transformation, Artificial Intelligence, Machine Learning, Robotic Process Automation, Big Data, Analytics, Internet of Things, and Blockchain also require a different level of skill and quality of output than was needed in the past.

This shift in priorities for outsourcing has created incredible opportunities for Latin America. The region provides time zone advantages and cultural compatibility for nearshore services that are proving to be attractive for buyers, especially from the United States. Although they may fall behind the more mature Asian counterparts such as India and the Philippines in terms of cost savings and scalability, they are proving to be tough competition when it comes to skill level and quality of output.

Taking advantage of high-quality tech talent and software development teams fluent in the latest technologies, global firms such as Amazon, Google, Alibaba, and many others are expanding their footprint in the region. The IT revenues of outsourcing service providers from Latin America grew approximately 20 percent from 2016 to 2017. Along with IT outsourcing, other shared service functions such as finance & accounting and customer service are also gaining popularity in the region.

Many Caribbean countries such as Jamaica, Dominican Republic, and Puerto Rico are developing into major hubs for contact centers. With increasing English proficiency, the region provides a workforce that speaks four different languages – English, Spanish, French, and Dutch. The growth is largely driven by pan-Latin American projects and serving customers in high-cost locations such as the United States. In 2019, more than 25,000 jobs were created at 34 announced projects in Latin America and the Caribbean.

Opportunities and Challenges

Although there are currently scalability issues in some Latin American markets due to limited talent with high-level training and expertise, government, industry and corporations are now focusing on the need to build up talent pools. Organizations like the Inter-American Development Bank (IADB) and the Latin American Association of Service Exporters (ALES) are playing an expanding role in helping to develop technology and business services talent across many countries. In Medellin, Colombia, for example, efforts there have resulted in a global reputation as an innovation center, joining cities like Guadalajara, Sao Paulo, Buenos Aires, and San Jose, Costa Rica as cities with highly skilled labor pools.

Geopolitical risks such as social unrest and natural disasters are often a threat to businesses operating in Latin America. As an example, in July 2019, large scale protests in Puerto Rico that led to the Governor’s resignation caused economic and political uncertainty in the region. Then later in August 2019, protests against mining efforts in Peru blocked several highways causing major business disruptions in the country. Corruption and drug-related crimes also continue to pose a problem in some parts of the region. Before entering the Latin American market, a though understanding of the region and location risks must be evaluated and addressed before companies can capitalize on the capabilities the region offers. On an ongoing basis, location-based risk events should be monitored so that effective mitigation steps can be taken to minimize the risks of business disruption.

Countries to Watch

Velasquez shares his expertise and insights on these areas to keep on the radar screen:

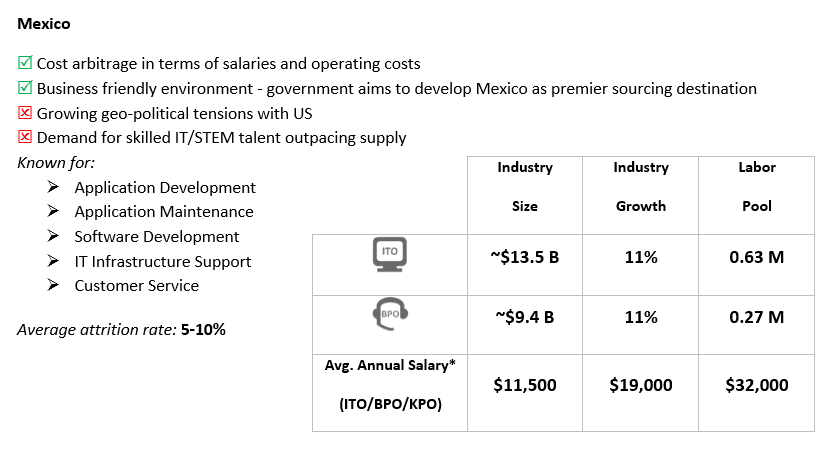

Brazil and Mexico: These large countries have been long-time participants long in outsourcing and offer solid capabilities in terms of people and companies. Mexico has providers both servicing the local market and exporting services for the U.S. market. Brazil has taken a similar approach and also has established operations in other countries to serve regional markets.

Costa Rica: A strong and long-time participant, this country has established itself for global services centers and business process services. It offers a stable government and political climate, but its smaller population can be an obstacle.

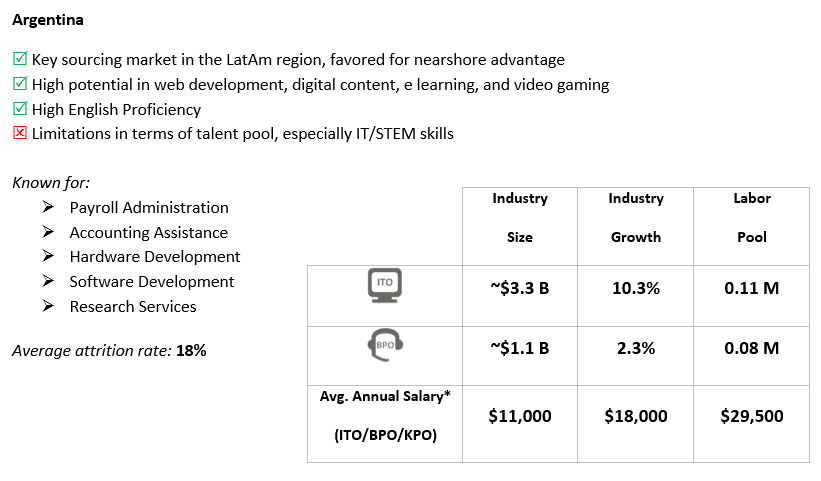

Argentina: Argentina suffers with its economic situation and constant political tremors. However, long-time companies in IT outsourcing are moving full steam ahead here, such as Globant and others.

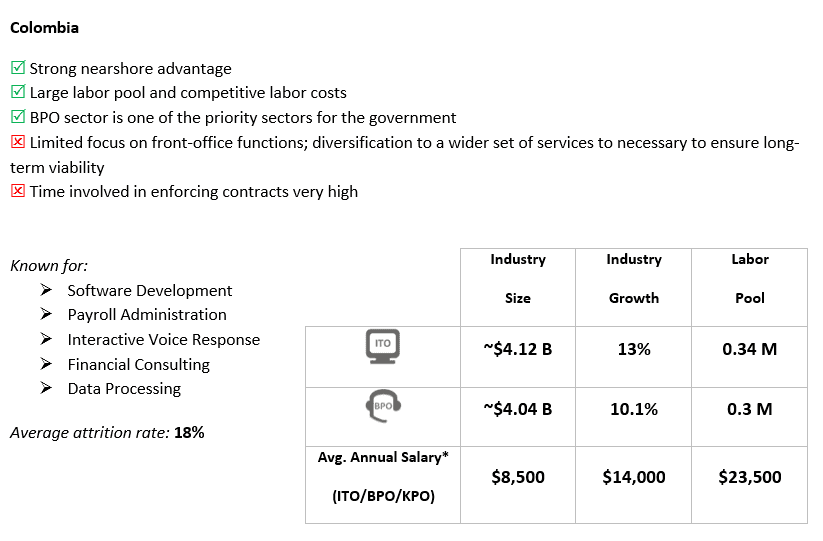

Colombia: Home to many multinational and multilatinas companies, this country offers political stability. A solid economy and foreign investment are allowing companies like Teleperformance, Amazon, Johnson & Johnson and many others to grow operations, generate strong financial results and create jobs. Colombian government participation and sponsorship of programs will improve talent acquisition in the long run.

Chile, Peru, Uruguay, Paraguay and Bolivia: Size matters and these countries are a mix of opportunities. Many of the key advisory and established IT companies are located in this part of the world, including IBM, TCS, HPE and others. At the same time, some interesting local and regional companies have emerged that are smaller in size and geographic footprint, but effectively deliver services to customers around the world. Business Processing Outsourcing exists on a smaller scale serving neighboring countries.

El Salvador, Guatemala, Jamaica, Trinidad & Tobago: Smaller is size, these areas are working in the BPO industry, mostly providing voice services for non-Spanish speaking countries in the U.S. and some small portions of Britain as well.

Market Recap

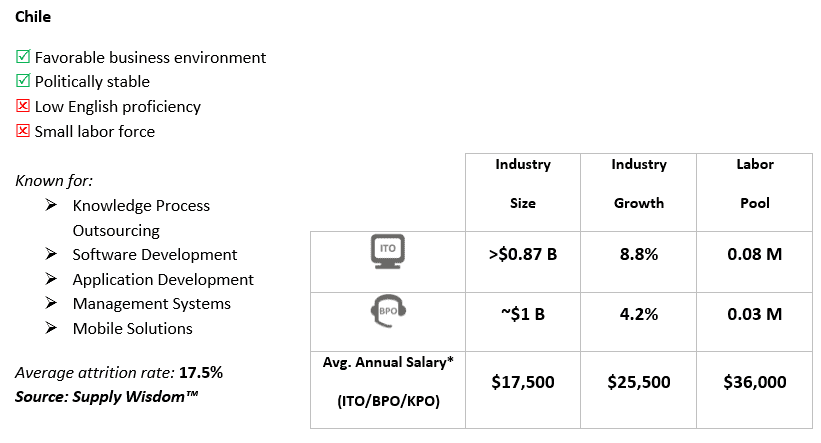

According to NeoGroup company’s Supply Wisdom, the overall opportunities and challenges in the Latin America and Caribbean Region can be summarized as below.[/emaillocker]

This just in…

Leading Hubs in Latin America

*Please note the salary numbers are indicative and actual numbers would vary depending on role, skill-sets and experience level

About Supply Wisdom™

Supply Wisdom was launched in 2012, out of a need for an early warning service to help enterprises detect and prevent disruptions. Today, Supply Wisdom equips global enterprises with continuous third-party and location-based risk intelligence, real-time risk monitoring, in-depth risk assessments, and risk scorecards to minimize the risks of disruption facing their business and third parties. TPRM, GRC, Sourcing, Vendor Management, and Security professionals use Supply Wisdom to maintain business continuity, mitigate risks, and strengthen their sourcing operations. Supply Wisdom is a Neo Group company. More information at www.supplywisdom.com.