The Clash of Contingent Workforce Managed Service Providers and Procurement Outsourcing BPOs

By: Ankaj Moohindroo, Senior Analyst, Everest Group and Shirley Hung, Vice President, Everest Group

Driven by an increasing need for organizations to fill talent gaps, coupled with changing workforce expectations, the contingent workforce has grown rapidly – to the point that it has become a key constituent of the overall workforce.

As it has grown, its role has evolved from supporting the permanent workforce to fulfilling key business requirements on its own. In order to meet demand, the traditional contingent workforce source – temporary labor procured from staffing agencies – is being supplemented by fast-growing leverage of Statement of Work (SOW) engagements. Since SOW engagements are contracts with third-party professional services firms (e.g., for the procurement of IT, marketing, consulting, legal, and other services), which involves sourcing and managing third-party services, it is also known as services procurement.

[emaillocker id=”26087″]Current spend on third-party services, such as SOW engagements, is quite large and expected to grow. Unfortunately, the majority of this spend remains invisible or unaccounted for and is not managed as effectively as temporary labor spend. While organizations are beginning to recognize the importance of closer management of third-party services spending, most organizations lack the requisite capabilities to do so effectively. This is where third-party expertise comes in to play.

A natural choice for some organizations thinking about outsourcing the management of SOW spend is Procurement Outsourcing Business Process Outsourcing (PO BPO) service providers, which are already known for managing indirect procurement spend. However, other organizations are taking a different route – reaching out to their temporary workforce Managed Service Providers (MSPs) to manage transactional elements of their SOW spend, such as headcount tracking and administrative support. As a result, these two types of BPO providers, POs and MSPs, are increasingly competing for the same scope of services.

A natural choice for some organizations thinking about outsourcing the management of SOW spend is Procurement Outsourcing Business Process Outsourcing (PO BPO) service providers, which are already known for managing indirect procurement spend. However, other organizations are taking a different route – reaching out to their temporary workforce Managed Service Providers (MSPs) to manage transactional elements of their SOW spend, such as headcount tracking and administrative support. As a result, these two types of BPO providers, POs and MSPs, are increasingly competing for the same scope of services.

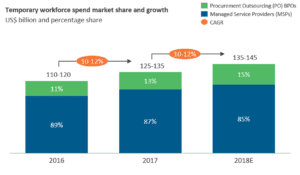

With this growing competition, we are seeing an increasing convergence; MSPs are encroaching upon the space that traditionally has been the PO BPOs’ territory, while PO BPOs are also making inroads into the MSP space by managing temporary workforce spend of organizations as part of their broader indirect procurement outsourcing engagements (see Exhibit 1).

Although MSP SOW spend under management continues to grow rapidly, the amount of this spend remains small enough that it is not yet a significant threat to PO BPOs (see Exhibit 2). However, as both sets of players continue to play in each other’s territories, we anticipate a “cold war” brewing between the two in the near future. At this point, it’s hard to say which will “win,” as the two types of BPOs are approaching services procurement from different directions.

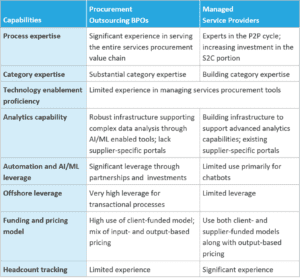

Effective management of services procurement requires specific capabilities and niche expertise. From the perspective of establishing a services procurement solution, PO BPO providers have the edge over their MSP counterparts when it comes to the ability to manage the entire Source-to-Pay (S2P) cycle. PO BPO providers also demonstrate category expertise – specific knowledge of different services procurement categories. In addition to process and category expertise, PO BPOs are expert in managing e-procurement solutions, which, when proven, may be an asset as technology enablement proficiency is key to the successful implementation of services procurement solutions.

Effective management of services procurement requires specific capabilities and niche expertise. From the perspective of establishing a services procurement solution, PO BPO providers have the edge over their MSP counterparts when it comes to the ability to manage the entire Source-to-Pay (S2P) cycle. PO BPO providers also demonstrate category expertise – specific knowledge of different services procurement categories. In addition to process and category expertise, PO BPOs are expert in managing e-procurement solutions, which, when proven, may be an asset as technology enablement proficiency is key to the successful implementation of services procurement solutions.

By contrast, most MSPs are talent management experts, with extensive experience in headcount tracking and billing and payments. Many MSPs are investing in the necessary technologies and talent to manage services procurement, but on the whole, MSPs do not currently have the requisite category expertise. In technology enablement, MSPs are masters of VMS implementation and usage, which, like e-procurement, may be a benefit once that expertise is proven.

Once a services procurement solution is in place, it is essential to optimize core processes and manage desired outcomes on an ongoing basis. Two core technologies that support and enable optimization are analytics and automation. Analytics provides visibility into an organization’s spend on services procurement and supports spend reduction through peer benchmarking and market analytics. In order to offer effective analytics services, providers need a back-end infrastructure (data warehouse, data normalization tools, etc.) combined with front-end tools (data visualization tools, portals, etc.) covering the different participants (suppliers, labor, etc.) in a services procurement engagement.

On a comparative basis, PO BPOs have stronger back-end infrastructures to enable analytics than their MSP counterparts. However, both service provider types have developed dynamic and interactive visualization tools to support enterprise users.

While analytics enables optimization of specific outcomes, automation and Artificial Intelligence/ Machine Learning (AI/ML) promise process efficiency through: automation of manual tasks in various underlying processes; and enhanced customer and supplier engagement through the leverage of chatbots. PO BPOs are ahead of most MSPS in automation and AI/ML given their large-scale investment budgets and partnerships with RPA providers (across their different BPO offerings).

Other key components of a successful services procurement solution include headcount tracking, leverage of offshoring, and use of relevant pricing and funding models. Ineffective headcount tracking – lack of visibility into SOW consultants working in an organization – poses multiple financial, business, and operational risks. Thus, headcount tracking of both employee and non-employee populations is crucial. MSPs shine in this area in relation to PO BPOs – they have built this expertise as part of their temporary workforce management offerings, whereas PO BPO providers do not traditionally have any specific offering or expertise.

From a cost savings delivery perspective, offshoring is one of the most common and effective tools for service providers. PO BPOs have been using offshoring extensively in their indirect procurement operations for years, developing real and proven expertise. MSPs, on the other hand, have only recently started using offshoring to a significant extent.

From a cost savings delivery perspective, offshoring is one of the most common and effective tools for service providers. PO BPOs have been using offshoring extensively in their indirect procurement operations for years, developing real and proven expertise. MSPs, on the other hand, have only recently started using offshoring to a significant extent.

Last, but not least, are considerations around pricing and funding models. The funding model is an important consideration, as financial support is essential for both the implementation and the sustainability of an outsourcing program. Similarly, a transparent and practical pricing model is crucial for the longevity of the program as it needs to serve both the client’s and the service provider’s interests. While PO BPOs are more comfortable with client-funded models, MSPs are more flexible, using both supplier-funded and client-funded models. In terms of pricing models, PO BPOs use a mix of input- and output-based models. MSPs use output-based pricing models, primarily fee as a percentage of the managed spend. P2P-focused contracts leverage transaction- and FTE-based pricing models extensively, S2C-focused contracts use managed service fee models.

While each service provider type offers specific capabilities that make them suitable for servicing different elements of the services procurement value chain, neither has the full spectrum of capabilities needed to service the entire spectrum of SOW management tasks. Service providers are aware of their limitations and are making investments to build these additional capabilities. Buyer enterprises should clearly identify expectations from a services procurement solution after which they can match service provider capabilities to their requirements and select the right provider to manage their SOW engagements.

As for who will win in the battle for the services procurement scope of work, MSPs or PO BPOs, it will depend on which service providers are able to quickly and effectively bridge the gaps in their offerings to provide that holistic set of capabilities that organizations are demanding.

Want to learn more? See the full report The Clash of Contingent Workforce MSPs and Procurement Outsourcing (PO) BPOs.

[/emaillocker]

About the Authors:

Ankaj Mohindroo is a member of the Business Process Services team and assists clients on topics related to the entire HR and talent services value chain including permanent and contingent talent acquisition, payroll, benefits, learning, broader talent management, and multi-process HR outsourcing. Mohindroo’s responsibilities include leading Everest Group’s Recruitment Process Outsourcing (RPO), Managed Service Provider (MSP), and HR Outsourcing (HRO) offerings. Prior to joining Everest Group, Mohindroo was an Analyst with Ernst & Young. He holds an MBA from Punjab University’s University Business School and a Bachelor from Punjab University, Chandigarh.

Ankaj Mohindroo is a member of the Business Process Services team and assists clients on topics related to the entire HR and talent services value chain including permanent and contingent talent acquisition, payroll, benefits, learning, broader talent management, and multi-process HR outsourcing. Mohindroo’s responsibilities include leading Everest Group’s Recruitment Process Outsourcing (RPO), Managed Service Provider (MSP), and HR Outsourcing (HRO) offerings. Prior to joining Everest Group, Mohindroo was an Analyst with Ernst & Young. He holds an MBA from Punjab University’s University Business School and a Bachelor from Punjab University, Chandigarh.

Shirley Hung is a member of the Business Process Services team. She advises senior stakeholders of global services including enterprises, service providers, and investors, in their strategic mandates and initiatives. Hung’s responsibilities include leading Everest Group’s Finance & Accounting Outsourcing, Procurement Outsourcing, and Customer Experience Management Services subscription offerings.

Prior to joining Everest Group, Hung was General Manager Strategy with Rio Tinto, leading the strategy team for Global Business Services. Previously, she held various consulting and strategy roles at Mercer HR Consulting, The Hackett Group, Charles Schwab and Arthur D. Little. She holds a Bachelor of Science degree in Chemical Engineering from the Massachusetts Institute of Technology and a Masters of Science degree in Philosophy, Policy and Social Value from the London School of Economics.